Woodlands Mutual Prepayment Program

The program described below expired in 2019. The Board may elect to do a second round of prepayments at some point in the future.

The Woodlands Mutual Water Company (WMWCo), in cooperation with the Nipomo Community Services District (NCSD), has taken steps to enable property owners within the District (the “Participants”) to make a one‐time prepayment against the Principal Balance of outstanding capital loans related to the District and the purveyance of water. The prepayment of capital obligations would allow WMWCo to re‐amortize the loans or reduce the loan terms, thereby reducing the total expected amounts to be paid. By reducing the costs of these capital loans, WMWCo can reduce the costs passed through to District Participants on their water bill.

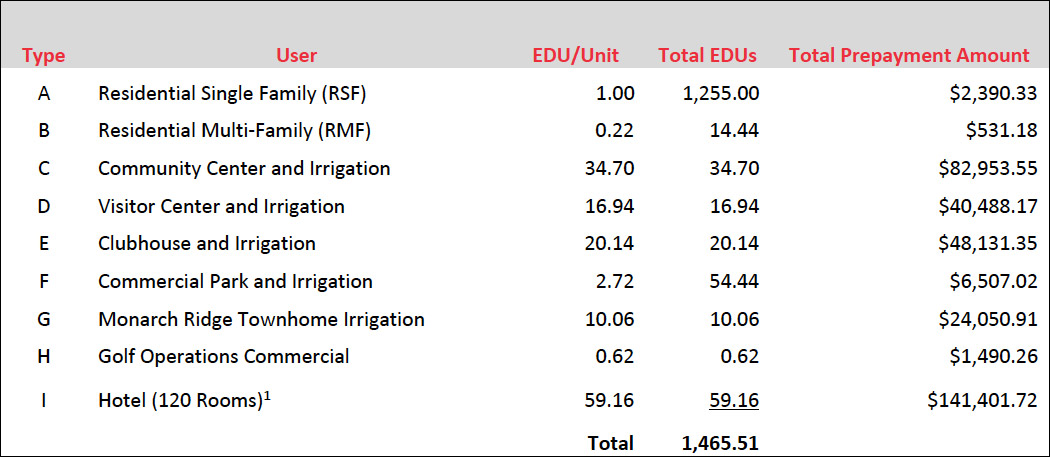

This Prepayment Program (the “Program”) gives each Participant the option to prepay the principal portion of their individual share of all outstanding capital loan amounts. A Total Prepayment Amount has been calculated for a variety of connection types within the District based on water‐use rates. As shown below, a Residential Single Family unit has a Total Prepayment Amount of $2,390.33 and an EDU factor of 1.00. All other connection types have a Total Prepayment Amount that reflects the relationship between land‐use classes and is demonstrated by the EDU factors listed.

The Total Prepayment Amount by connection type is indicated below.

Each Participant will receive a personalized mailer (the “Prepayment Notice”) that summarizes this program along with their individual Total Prepayment Amount, Total Credit, and Net Prepayment Amount. The Total Credit for each Participant will be determined based on the number of years that Participant contributed to the Supplemental Water fund between 2006 and 2014, as well as any Principal amounts paid to date.

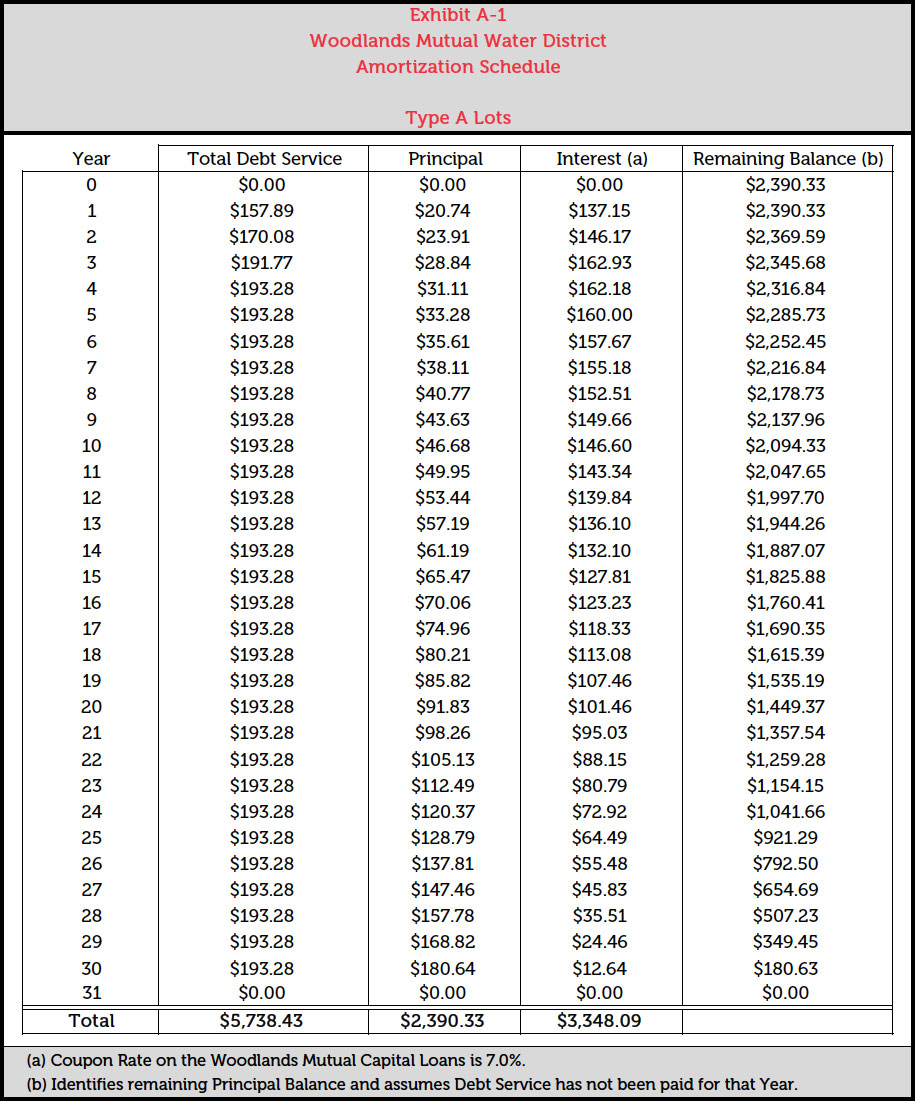

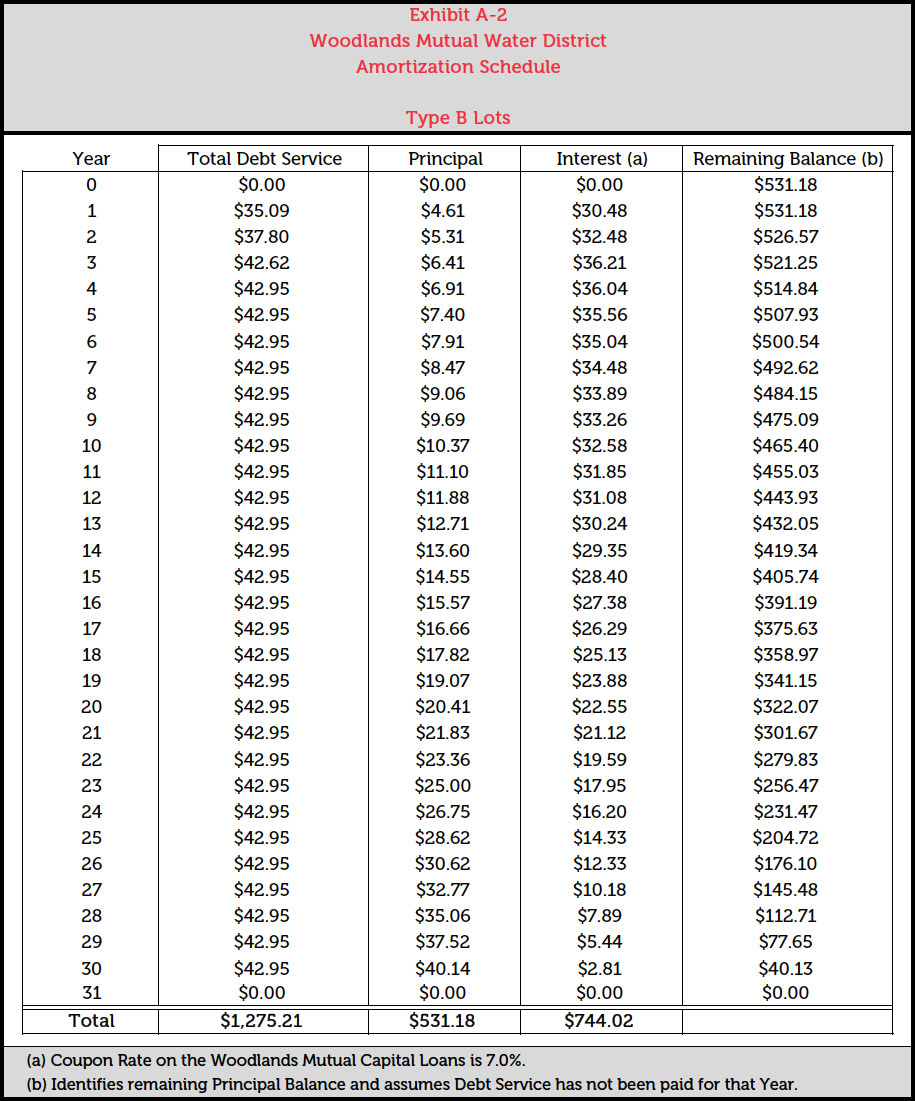

If a Participant chooses to pay the Net Prepayment Amount, their monthly Supplemental Water charges will be reduced to reflect services charges only and will no longer include capital loan charges related to the Water District’s outstanding debt service. As an example of the Program’s potential benefit, a Participant with a Single Family Residential unit who has lived within the District area since 2014 would have a Net Prepayment Amount of $2,390.33. By choosing to prepay, the Participant would save approximately $3,348.09 over the full loan term extending to 2045. The Amortization Schedule for each connection type can be found further down this page and demonstrates the typical payment schedule for Participants who do not prepay.

Participants intending to prepay shall provide Woodlands Mutual Water Company with (i) written notice of intent to prepay, (ii) payment of fees established by the Woodlands Mutual Water Company to process the prepayment request, and (iii) delinquent charges outstanding at the time of prepayment with respect to the property’s Lot Number. The Prepayment Notice distributed in the mail may serve to satisfy requirement (i).

General Background & Methodology

WMWCo currently has four (4) loan schedules with the Nipomo Community Services District (NCSD) for its share of the Supplemental Water Project capital loans. NCSD has offered to allow WMWCo to make a one‐time capital prepayment against the principal balances of such loans; capital prepayment would allow for the re‐amortization of the loans, reducing WMWCo’s total expected loan payment amounts, or, alternatively, loan terms. By reducing the costs of this capital loan program, WMWCo can reduce the costs passed through to District Participants.

As of December 31, 2018, the Total Current Principal Balance of the capital loans (the “Principal Balance”) is equal to approximately $3,372,562. Within the District, there are approximately 1,465.51 Equivalent Dwelling Units, or sEDUs, which effectively represent the number of homeowners or Participants in the District, taking into account all land‐use and connection types. As seen below, a Residential Single Family unit equates to 1 EDU; a Multi‐Family unit equates to approximately 0.22 EDUs; a Community Center and Irrigation facility equates to approximately 34.70 EDUs; and so forth. To calculate the Prepayment Amount for each Participant, WMWCo has divided the Principal Balance by the total number of EDUs (1,465.51), thereby spreading the costs of program equitably across all Participants. WMWCo will notify Participants should additional debt service be issued for the District.

Notably, Participants that have paid Supplemental Water fees between 2006 and 2014 will receive a Credit against those fees based on the total WMWCo Net to Savings collected between those years — Net to Savings being defined as the remainder of Total Revenue minus Net Expenses in the Supplemental Water fund. WMWCo currently has $300,000 in Net to Savings, all of which is available to pay toward the Principal Balance.

To appropriately apportion Net to Savings, the total was divided proportionately among each year between 2006 and 2014. Next, each year’s proportional amount was divided by the total number of EDUs that contributed in that given year; the result is a Credit per EDU for each year. Using that value, each Participant between 2006 and 2014 has had a Total Credit amount calculated by multiplying the number of EDUs/units owned by the Credit per EDU for each year, aggregated. This establishes the Total Credit methodology employed in order to equitably apply WMWCo’s Net to Savings.

Should you have any further questions, please call us at (800) 969‐4DTA.